Know Your Rights

Quick Contact

Know Your Rights

The Fair Credit Reporting Act (FCRA) was enacted to protect the privacy and accuracy of information used by credit or consumer reporting agencies. It gives you all of the following rights and more.

You are entitled to notification if consumer or credit reports have been used against you.

If you have been refused credit, employment or housing due to information found in a background check, credit report, or other form of employment screening, the parties who used this information must inform you about it and provide the name, address, and phone number of the agency that furnished them with the information.

A copy of your file must be provided to you.

You have the right to request a copy of your file from any consumer reporting or credit reporting agency. (To obtain a copy you must provide proper identification.) In addition, you may be entitled to a free file disclosure if:

- The report’s information was used against you

- There is a fraud report on your file resulting from identity theft

- Your file contains fraudulent mistakes

- You are receiving public assistance

- You are unemployed and will be looking for work within the next 60 days

You are entitled to one free credit report every 12 months.

To receive your free report, you must request it from each of the three large credit bureaus: Expedia, TransUnion and Equifax.

You have the right to request, and receive, your credit score.

The consumer agencies that create or distribute credit scores must provide you with your score if you ask for it. However, they have the right to charge you for providing this information.

If there are errors on your consumer reports, you have the right to dispute them.

You can report errors on your credit report, any consumer report and any background check to the parties that provided the erroneous reports. The parties must then investigate the errors. If they cannot verify that the information they provided is correct, the parties must remove the inaccurate information in 30 days or less.

Negative information that is outdated cannot be reported.

Negative information that is more than seven years old cannot be used in a credit report. Similarly, bankruptcies that took place more than ten years ago are not allowed to be reported.

Access to your information is restricted.

Only parties with a legitimate need for your information (such as an employer, an insurer, a creditor, or a landlord) can access it in consumer reports.

To access your consumer reports, employers must receive your consent.

Any potential or current employer must have written consent to access your credit report, background checks or other screenings. This requirement does not apply to situations involving the trucking industry.

You have the right to seek damages.

You are allowed to sue consumer reporting agencies that have violated the Fair Credit Reporting Act. In certain situations, you may also sue the person who used such information.

If you believe your rights have been violated, contact us for a free consultation with attorney Robert Murphy to discuss your situation.

In most cases, we will not charge you unless we obtain compensation on your behalf.

About Us

Robert W. Murphy

Consumer fraud attorney Robert Murphy is a trial lawyer who practices in the areas of consumer litigation in Florida, Georgia, Virginia, and Wisconsin. In nearly 40 years of practice, he has actively litigated cases under almost every aspect of federal and state consumer protection laws, including the Fair Debt Collection Practices Act (FDCPA). He has acted as lead counsel in the litigation of cases both individually and on a class basis in venues across the country. He is dedicated to advancing the consumer rights of Americans through both courtroom advocacy and the education of families and individuals concerning consumer protection laws. Read more…

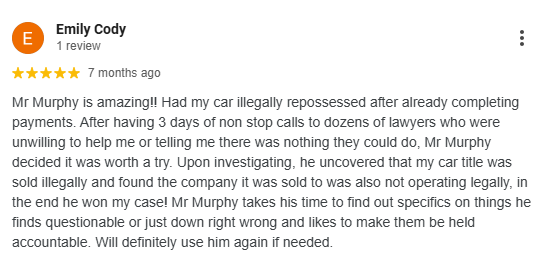

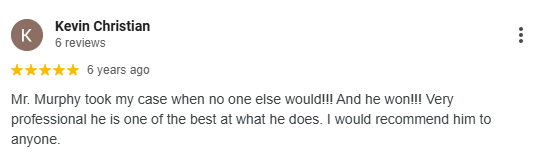

Here's What People Are Saying About Murphy Law:

CONTACT US TODAY!

If you have been the victim of unlawful fraud or repossession, contact a consumer rights attorney at Murphy Law today.

Contact Information

- Contact Information

219 Davie Boulevard

(aka 219 SW 12th Street)

Fort Lauderdale, FL 33315

- Phone

- Fax

(954) 763-8607

Send Us A Message

"*" indicates required fields