The Fair Credit Reporting Act

Quick Contact

The Fair Credit Reporting Act

The Fair Credit Reporting Act is a federal statute that was enacted in 1970. It was created to protect the rights of consumers and regulate the practices of parties who provide information to credit reporting agencies, the credit reporting agencies themselves, and those who use such reports. The FCRA permits consumers to make legal claims against and sue credit reporting agencies, creditors and debt collectors who report erroneous information. Violations of the FCRA include:

- Failing to report a discharged debt in bankruptcy

- Reporting information that is more than seven years old or reporting old debts as new

- Reporting debts that have been settled

- Charging late fees on debts that were paid on time

- Providing credit information even though identity theft has been reported

- Mixing the credit information of different parties

- Failing to correct inaccurate information from a debtor’s file

Violations of the FCRA by credit card companies, banks and other entities that provide information to a credit reporting agency (CRA) include:

- Notifying CRAs that a debtor has disputed a debt

- Failing to investigate a disputed debt within 30 days

- Failing to provide a debtor with information needed to complete the dispute process

- Failing to report results of an investigation to the debtor

- Providing information to CRAs that is known to be inaccurate

If you believe a creditor, credit bureau, or credit information provider has committed one or several of the above violations, contact our FCRA attorney as soon as possible for an evaluation of your case. We may be able to file a lawsuit and obtain compensation for damages on your behalf.

Contact us today.

In most cases, we will not charge you unless we obtain compensation on your behalf.

About Us

Robert W. Murphy

Consumer fraud attorney Robert Murphy is a trial lawyer who practices in the areas of consumer litigation in Florida, Georgia, Virginia, and Wisconsin. In nearly 40 years of practice, he has actively litigated cases under almost every aspect of federal and state consumer protection laws, including the Fair Debt Collection Practices Act (FDCPA). He has acted as lead counsel in the litigation of cases both individually and on a class basis in venues across the country. He is dedicated to advancing the consumer rights of Americans through both courtroom advocacy and the education of families and individuals concerning consumer protection laws. Read more…

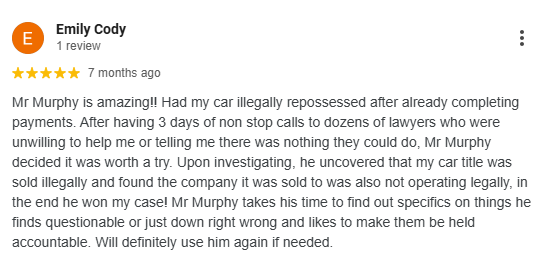

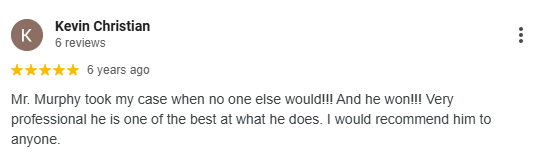

Here's What People Are Saying About Murphy Law:

CONTACT US TODAY!

If you have been the victim of unlawful fraud or repossession, contact a consumer rights attorney at Murphy Law today.

Contact Information

- Contact Information

219 Davie Boulevard

(aka 219 SW 12th Street)

Fort Lauderdale, FL 33315

- Phone

- Fax

(954) 763-8607

Send Us A Message

"*" indicates required fields